Create a Student Invoice

Studioware contains extensive functionality to create and track student invoices. Student transactions are accumulated in the student (or family) accounts and can be placed on invoices. The invoices can be printed and mailed to the payees or emailed to the payees. The invoices can contain a "Stub" that the payees can return with their payment.

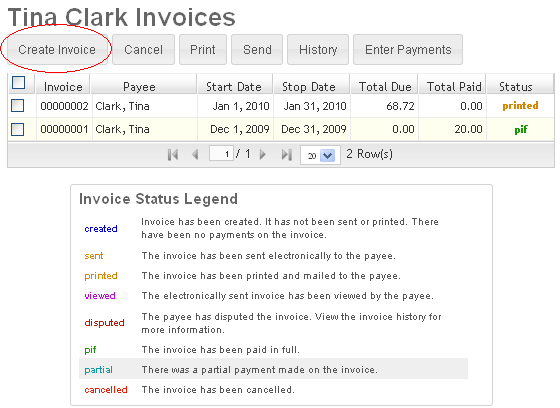

Studioware tracks the status of all invoices. Initially, invoices have a "Created" status. As invoices are printed and emailed, they are switched to "Printed" or "Sent" status, respectively. Invoices that have partial payments applied are set to "Partial" status. Invoices that are paid in full are set to "PIF" status.

Studioware will also contain an Invoice Aging Report (currently under development). This report will show you all outstanding invoices and provide you with the payee contact information so you can inquire about the outstanding invoices.

Creating a Student Invoice:

- Search for a student (or select a student from the Student Grid).

-

Open the student record and click on "Invoices" on the side menu:

-

On the Invoices toolbar, click on the "Create Invoice" button:

-

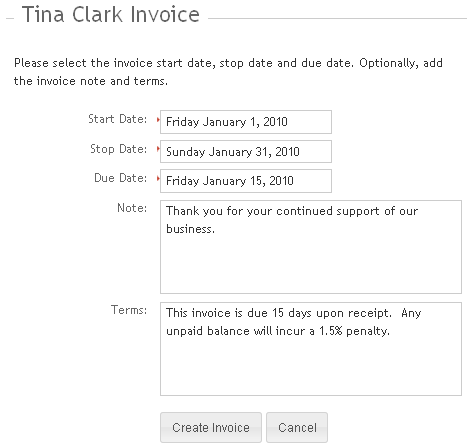

Enter in the invoice start date, stop date, due date, notes and terms. Click on the "Create Invoice" button to create the invoice:

- The invoice will be created and populated with transactions from the Student's account based on the invoice date ranges.

A transaction from a student account can only be on one invoice. For example, if you create an invoice for a student for the current month and then immediately you create a second invoice for the same student for the current month again, the second invoice will have a balance of zero because all the transactions are on the first invoice. If new transactions occur during the month after an invoice is created, the new transactions can be placed on a new invoice. Canceling an invoice will remove the transactions and make them available to be placed on a new invoice.